Introduction

As we all talk about covid nowadays, digital experts also talked about how covid has started the digital transformation in all technology areas. In this article, where I publish my own personal ideas, I will share my expectations how the financial technology landscape will look like after covid.

It is obvious that Covid has changed our understanding of digital finance. The digital customers who are accustomed to use digital channels (mobile, internet, ATM, CC) had no major change in their interaction with banks. We can also say that this a majority of the banked population. Major players in the market say that more than 90% of their transactions are on digital channels. In addition, only 1/3 of the credits are operated in their physical branches. On the other hand, what about the 10% and 1/3 of credits when the branches were closed during Covid?

What simply happened is, with the help of technology, banks adapted their processes as to cover the new unattended version of digital transactions. I do not need to be a fortune teller to say that the risk coefficient has increased for the banks and for the nondigital customers. In addition, customer onboarding processes has been modified to adapt the closed branches, but in terms of KYC, banks might have issues. Of course, the authorities also helped banks to loosen the strings during Covid.

So, after this small introduction, let’s dive into what will happen in near future, from the point of view of the customers and the banks.

As of my understanding, the expectations of an individual form a bank has not changed in principle. The basic motives are:

- Understand my financial interest and needs

- Forecast what I might need and propose

- Take actions in a timely and secure manner

Assistance

Complexity of life increases every day. An ordinary person needs to remember a lot of things, not only financially, but daily life requires lots of attention. That’s why we use smart and smarter phones, health trackers, some kind of assistance. In a very short time, we will need a personal digital assistant like we need/use a smart phone today. In addition, this assistant is an aggregator of all your digital life. Your digital assistant can be accessed anytime and anywhere. At home you can use by voice, in motion, you can use as you are using your smartphone app.

Imagine you have a time deposit end of value date, or a credit/credit card payment. When you wake up in the morning and an example dialog can be:

- You: “What is my agenda today?”

- DA: “You have meeting with the executives of XYZ company at 09:30. I recommend a business attire. You need pay for your credit card and your son’s schools’ 3rd installment in BANK1. BANK2 has informed that tomorrow is the value end date of your time deposit account.”

- You: “Thank you for your recommendation. Pay the credit card and the installment.”

- DA: “Your total balance will not be enough for your payments in BANK1. If overdraft is used, I can make the payments. Do you want me to use overdraft? “

- You: “No. What’s my total balance in BANK1? “

- DA: “12.345TL and 50 kuruş.”

- You: “OK. Pay the installment completely and pay credit card partially with the remaining balance.”

- DA (probably after a few seconds): “Done. Partial payment to your credit card will cost you an interest of 150 TLs.”

- You: “OK. Thanks. Notify me if BIST index rises by 2%.”

- DA: “OK. Have a nice day.”

Does it sound a bit science-fiction? Not at all. How can we make this scenario possible?

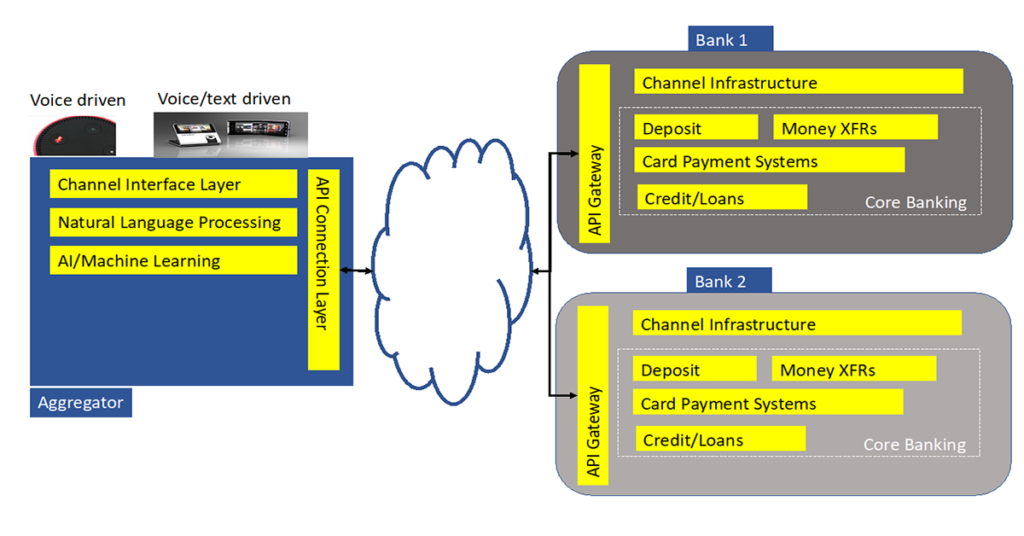

My expectation in near future is that the banks will be service centers, but their physical presence will be much less compared to today’s landscape. So, having said that, a basic schema for the above scenario to be possible is:

This architecture is based on the fact (or assumption) that banks can act as a service supplier and the aggregator is a certified & trusted 3rd party. Banks will be the back-end financial party of any personal assistant.

Personal assistant can also help you in investment consulting, again via banks’ services. There will always be the option if the customer (you) wants to talk to the bank directly. This option will always be available, although I believe that this will be used much less frequent.

When you connect to your bank, like todays’ call centers, you will be connected to a welcome receptionist or an expert depending on the reason of your call. Most probably you will never understand if you are talking to a real person or a voice bot, and you will not care unless you get the expected service.

Customer onboarding

In order to get the benefits from these services, you must be a member of the financial institution. This brings us to customer onboarding problems. Today, we have Know Your Customer (KYC), GDPR (general data protection regulation), customer signature problems in customer onboarding. These regulations are for security, but they are also barriers for fully digital customer onboarding processes. Can there be a way creating a full digital customer onboarding process without conceding security & trust in near future?

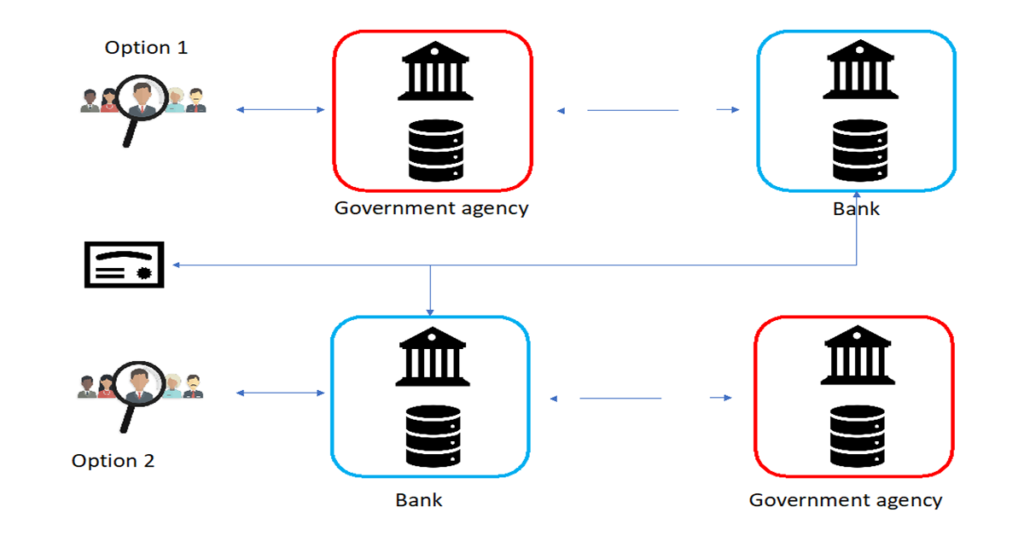

Imagine that there is an authorization party which grants you as a person to an institution. This party will have your personal (and probably biometric) information and share this info to the enterprises that you permit. Would you trust such a company? The answer is simple: NO. Unless it is the government institution. Whether you trust or not you share your data with your government. You can either authorize the government agency or the bank to share/get your data. Then you can directly become a digital customer of a bank. (New national ID cards can be a good way of implementing this process in very soon).

Option 1: Give your consent and request to the agency that you want your data to be shared with bank. Agency shares your data and PI. Bank receives the info and completes the customer onboarding process.

Option 2: You submit your request to a customer. Banks requests your consent to receive your PI data form the agency, you provide your consent, bank gets the info and completes the customer onboarding process. In this option, you can visit a phigital presence of the mentioned bank.

Cash & ATM

We need cash. We needed it and we will need it. Including non-banked population, cash will be on the market as long as humans use it, as long as there is unregistered trade in the market. Maybe some countries like Denmark can manage to transform cashless society, but it is very difficult – not impossible – for our country. That means we will see ATMs on the field for a while. Covid has certainly changed our perception about cash and ATMs. Most of us tried not to touch ATMs and cash as much as possible. Some banks have changed their mobile & ATMs applications not to touch ATMs. In any case, because of human nature and some nonregistered economy, there will be use of cash. And this is not a result of technology shortage. Having said that, ATMs are being used for many things other than cash deposit & withdrawals even today. It will not be a surprise to think ATMs as a physical presence of a bank or a financial institution. It is 7x24 and via video calls, you can reach a digital or a real expert for consultancy, make voice/biometric verification through a physical channel, even sign a form or document via biometric signature if legislation still requires it. So, ATMs will be very skillful channel representing the bank. This channel will help the banks for customer onboarding during transition period until the process is fully digital.

Payment Systems

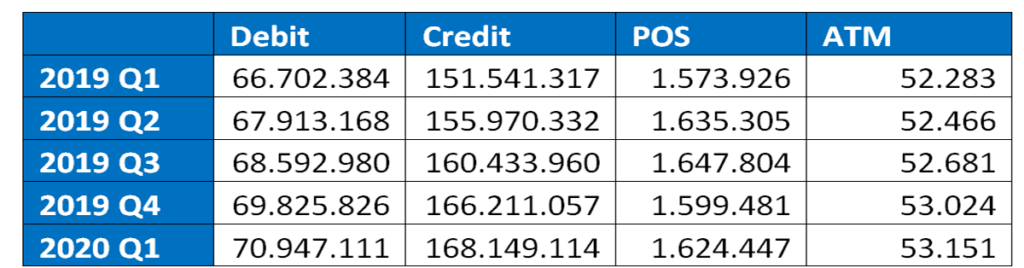

Technology and payment system providers are working on alternative ways of cashless transactions and they made a lot of progress. Mobile wallets, Apple pay, Samsung Pay, Google, NFC, wearable bracelets and rings are practical examples we can see even today. The assumption of new generation payment systems is that the plastic cards will not exist in the near future. The process of printing and delivering the card is both costly and in efficient. In addition, the need for POS terminals, distribution and support needs – even assuming the optimized process -, it requires a huge investment that banks are baring today. In short, the assumption is valid and logical. Covid had shown us the real potential of e-commerce. Without the use of a plastic card and a POS terminal, the volume of e-commerce has jumped by almost 40%. On the contrary, the number of plastic cards, ATM and POS terminals are increasing, because there is no alternative way other than e-commerce. It is not sustainable.

(From BKM Bulletin 2020. Note: Initially I added a graph, but the increase seemed to be marginal)

Also keep in mind that every bank has its own ATM & POS ecosystem. Common use of POS terminals has started, government banks has positioned to be leaders of common ATM and cards. The output of these projects will be very beneficial, better late than never. This vision for economies of scale should be common in the short term.

Wearables or future biometric chips/methods will replace the plastic card in near future. Even today, we see successful pilots of face recognition based payments in Asia (https://www.nngroup.com/articles/face-recognition-pay/). In our country, face recognition technology is used for gate securities in many software houses, even in some banks.

Back office tools and optimization requirements will also evolve. This is simpler, faster and leaner chargeback, clearance and most importantly security. Consolidated AI based system will detect immediately when a fraudulent case occurs. The processes triggered by the customer of by the system will be the leanest ones we see.

Availability & Resiliency

Having said that the banking will evolve to a different landscape with different infrastructures, the need for the service and service availability and resiliency will be as important as today. From the customer perspective, it may even be more important than today, since customers will be much less patient, more flexible and expecting more.

What can be a good way of providing this service availability level? Should the banks invest more and more to hardware and infrastructure? Is there an option as in common POC&ATMs, can there be a common data center usage for big banks? Or can government banks take a lead as they did in common card & ATM?

We can derive many more questions form these ones. To provide the necessary time to market and the required level of high availability & resiliency, banks and institutions must transform. I can tell that these transformations have already begun in the financial sector. Every single bank is transforming itself (maybe they think this is a differentiator, but I do not agree). To be cost efficient, sustainable, secure and available than ever, we need to move to cloud. In the future it may not be a cloud as we know it, but it sure needs to be an economies-of-scale based solution. Today, due to legislation, banks cannot move to cloud, because main providers do not have nodes in Turkey. Banks try to construct their private clouds to be ready for the next generation banking on cloud.

As in common POC, ATM and cards, imagine that financial institutions, not only banks, come together and build up a data center in Turkey to meet their total needs. I know it is easier said than done. Some of you might know that KKB has started an initiative, it can serve as a secondary disaster recovery purpose. I am imagining something bigger.

Another way is the legislators start to think in a different way, that I strongly recommend. Many data centers provide utmost security, data privacy and ownership at the highest level. (There is always risk of breach, I also believe this can be managed)

In any case, the journey is though, needs expertise and experience. Banks in Turkey has the best teams, technology and purchasing power. So as today, banks will have their “MAKE vs BUY” dilemma. Still, I definitely recommend they should find an experienced strategic partner to define and execute its strategy to new cloud, application infrastructure and faster time to market. This partnership is a critical one, it will define the differentiation & existence of the brand.

Transforming from the legacy monolithic application architecture to microservices, leveraging containers and being as ready as possible to edge computing and 5G will define existence of the brand.

Data & AI

I thank who read the text to this part with patience. I am aware that I did not mention data & AI a lot in the text. These entities are naturally built in all the part of the new generation banking model. In all parts of the customer journey, from on-boarding to attrition, in all the features of the products, C-levels & IT directors need to embed AI models to any relevant step of the process.

Summary

In short, C-levels and IT directors make take the following necessary measures to be ready for the new generation banking. If I were a CIO of a financial institution, I would:

- Find a strategic partner(s) to define and execute short,mid,long term targets

- Always put cybersecurity at the top of the list.

- Update my operational models continuously. Especially after the pandemic if not updated.

- Insert RPA and AI to any process possible to optimize cost.

- Embed AI and Analytics in every decision process.

- Always have good start-up ecosystem and Open banking.

- In short term, track new national ID card. This has a lot of potential for customer experience.

- Build contactless, biometric channels and branches (not as we know it), also new types of ATMs.

- Build a completely new technology, voice and AI driven contact center experience.

Thank you very much for reading my views on the next generation banking model.